Medicare Resource Center

Medicare Resource Center

Medicare Choices That Can Accidentally Raise Your Tax Bill

How certain Medicare decisions can raise your tax bill. Discover common mistakes involving income, HSAs, and premiums and how to avoid them.

Common Medicare Mistakes First-Time Enrollees Make

Many new Medicare enrollees make costly mistakes. Learn what to avoid when choosing coverage, drug plans, and enrollment timing.

How to Appeal Medicare Coverage Decisions

How to appeal Medicare coverage denials, understand your rights, and get the care or payment you need with clear steps and tips.

Preventive Services Covered by Medicare: Stay Healthy Without Extra Costs

Which preventive services Medicare covers at no extra cost, including wellness visits, screenings, and vaccines, and discover how to use these benefits to stay healthy and informed.

Understanding Medicare Star Ratings: What They Mean and How They Affect Your Care

How Medicare Star Ratings work, what they measure, and how they help you compare Medicare Advantage and Part D plans so you can make confident, informed healthcare choices.

Best Medicare Options for Frequent Travelers: Original Medicare vs. Medicare Advantage

The best Medicare options for frequent travelers, found by comparing Original Medicare and Medicare Advantage for coverage across states and abroad.

Who Is Eligible for a Medicare Special Enrollment Period?

Learn who qualifies for a Medicare Special Enrollment Period (SEP), what events make you eligible, and how to apply without facing penalties or coverage gaps.

Which Medicare Plan Offers the Best Support for Heart Disease Patients?

Choosing the best Medicare plan for heart disease? Learn how Original Medicare, Medigap, and Medicare Advantage compare in coverage, costs, and benefits for cardiac care, rehab, and prescriptions.

Comparing Medicare Plans: A Family Guide to Making the Right Choice

This family guide explains what to look for in coverage, costs, prescriptions, and provider networks to help seniors choose the right plan. Compare Medicare plans with confidence.

The Different Types of Medicare Penalties and How to Avoid Them

Learn about Medicare penalties for Parts A, B, and D, how they’re calculated, and simple steps you can take to avoid costly lifelong fees.

ANOC Guide: What to Expect from Your Annual Notice of Change

What your Medicare Annual Notice of Change (ANOC) means for your coverage, costs, and prescriptions. Understand key dates, how to review changes, and when to switch plans during Medicare Open Enrollment.

Comparing Medicare Plans: A Step-By-Step Financial Checklist

Compare Medicare plans with confidence using this step-by-step financial checklist. Learn how to evaluate costs, premiums, and income-based options to choose the right coverage for your needs.

How Medicare Advantage Plans Can Help Pay for Hearing Aids and Exams

How Medicare Advantage plans can help pay for hearing aids and exams. Compare coverage options, costs, and benefits to find the best plan for your hearing needs.

The Perks That Are Driving Seniors to Medicare Advantage Plans

Medicare Advantage plans are growing fast these days. Find out what perks are attracting seniors, from extra benefits to lower out-of-pocket costs, and how they stack up against Original Medicare.

Upcoming Changes to Medicare in 2025: What to Expect

Discover the major updates to Medicare in 2025, including expanded coverage, enhanced telehealth services, and drug price negotiations. Learn how these changes will impact your healthcare.

The Value of Local Insurance Agents in Navigating Medicare Coverage

Discover how local insurance agents and brokers play a crucial role in helping individuals make informed decisions about Medicare and health care coverage, ensuring personalized support and advocacy at no additional cost.

2026 Medicare Plan G Prices Vary Widely Based on Where You Live

Explore an in-depth analysis of 2026 Medicare Plan G prices in various cities, revealing significant variations across states to help you make an informed decision.

Understanding Medicare Part A: Insurance Coverage for Hospital Related Services

This article provides an in-depth guide to Medicare Part A, including coverage for inpatient care received in hospitals, nursing facilities, and at home, eligibility requirements, and associated costs. Readers will gain a clear understanding of the insurance coverage available for hospital-related services under Medicare Part A.

Medicare PPOs Explained

Medicare Advantage PPO plans offer seniors flexibility to see both in-network and out-of-network healthcare providers, often without needing referrals, though out-of-pocket costs may vary.

Medicare Part C

Are you looking for an alternative to Original Medicare? Medicare Part C, also known as Medicare Advantage, may be the perfect option for you. With low monthly premiums and added benefits, a Medicare Advantage Plan can provide you with the coverage you need.

Understanding What's Covered by Medicare

This article provides an overview of the Medicare coverage options available, including information on the different parts of Medicare, as well as additional programs and resources that can help with Medicare costs.

Understanding the Myths and Misconceptions Surrounding Medicare: 2023 Insider Tips and Information

Uncover common Medicare myths and gain valuable insights with our insider tips. Learn how plan options vary by location, the importance of annual plan reviews, potential savings on drug coverage, and what to watch for in Medicare Advantage plans in your state.

Medicare Supplement Plan G vs Plan N

Compare Medicare Supplement Plans G and N to understand their coverage differences, costs, and benefits, helping you choose the plan that best fits your healthcare needs and budget.

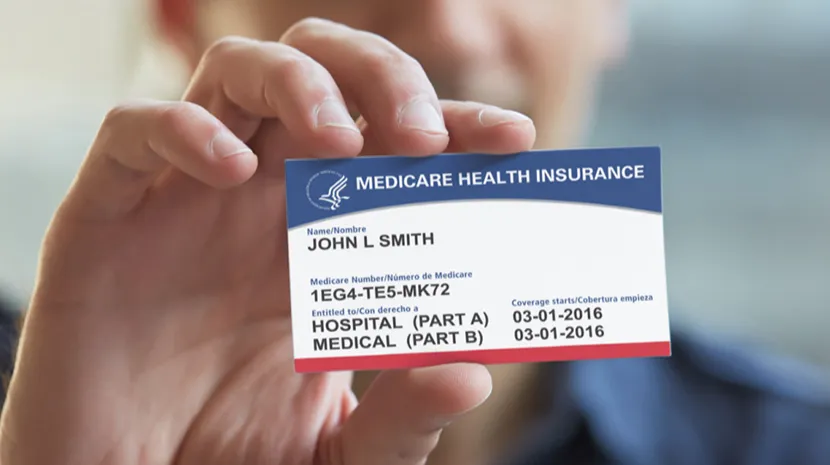

How to Apply for Medicare

Learn how to apply for Medicare with our written guide, covering eligibility requirements, enrollment periods, and application methods to ensure seamless access to your healthcare benefits.

How To Enroll in Medicare

Understand Medicare enrollment essentials, including eligibility criteria, required information, and enrollment methods, to ensure timely access to healthcare benefits.

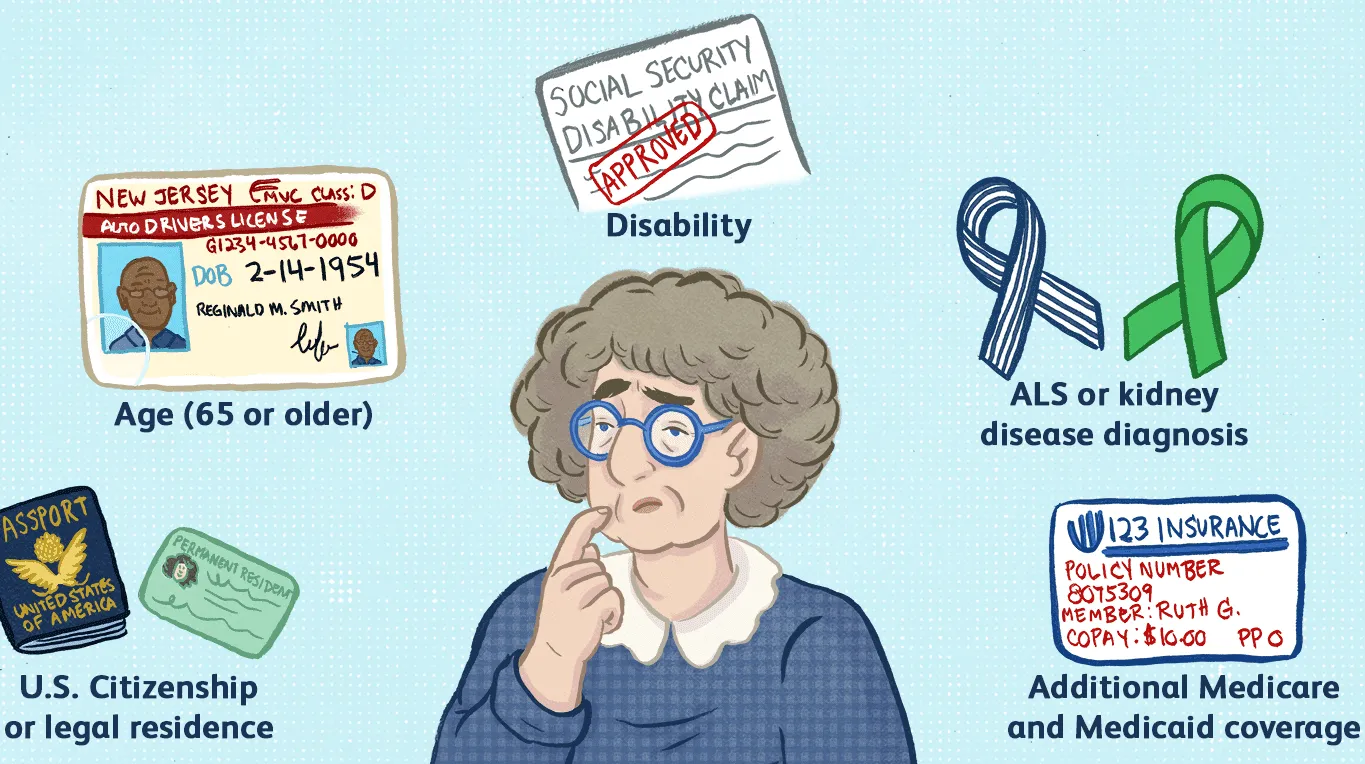

Who is eligible for Medicare?

Medicare eligibility is dependent on many factors including age, disability, and health conditions that qualify you for coverage. Find out if you’re eligible and how to enroll in your state.

Choosing Dental Coverage on Medicare

Getting the proper dental care is very important for our well-being. It's a decision that should be made with multiple factors in mind, such as the type of coverage that will best suit your needs and budget.

Is Vision Insurance Right For You?

Many people are mistakenly confused about vision insurance. It can be a confusing process when it comes to choosing a doctor for an eye injury or routine exam. A vision insurance policy can help pay for the cost of various eye procedures, such as eye exams and contact lenses. Some plans also provide coverage for laser eye surgery.

Medicare Supplement FAQs

Get answers to some of the most frequently asked questions about Medicare Supplement.

Medicare Part D FAQ

Get answers to common Medicare Part D questions. Learn about coverage, costs, enrollment, and how Medicare prescription drug plans work.

Donut Hole

The Medicare Donut Hole, also known as the Medicare Part D Coverage Gap, is a period during which Medicare beneficiaries who have prescription drug coverage through a Medicare Part D plan may have to pay a larger share of the cost for their medications.

What to Know About Original Medicare

The concept of Medicare was first established in the 1960s. It's a health insurance program for seniors that was initially only two parts: Part A and Part B. These two components are known as Original Medicare.

Medicare Supplement Enrollment Periods

Medicare Supplement enrollment periods are important for individuals who are enrolled in Medicare and want to add coverage for things that Original Medicare doesn't cover. These enrollment periods are set by the federal government and provide individuals with a specific window of time during which they can sign up for a Medicare Supplement plan.

Medicare Coverage

Learn everything you need to know about Medicare coverage in your state. Discover benefits, costs, and enrollment details to make informed healthcare choices.

Medicare Advantage FAQ

Answers to the most common questions about Medicare Advantage plans.

Medicare Part D Enrollment Periods

Find out when and how to enroll in Medicare Part D in your area. Learn about initial, annual, and special enrollment periods to get the right prescription drug coverage and avoid penalties.

What is Medicare?

Medicare is a national health insurance program in the United States that provides health insurance coverage to people who are 65 years of age or older, as well as to some younger people with disabilities or end-stage renal disease.

Medicare Advantage Enrollment Period

Understand the key enrollment periods for Medicare Advantage plans, including the Annual Election Period (October 15 to December 7), Medicare Advantage Open Enrollment Period (January 1 to March 31), and Special Enrollment Periods for qualifying life events.

What is covered under a Medicare Part D insurance plan?

If you have Medicare Part D, you will be able to get coverage for the cost of your prescription medications. This can help you save money on the cost of your medications, which can be expensive without insurance. Some Medicare Part D plans also provide coverage for other medical services, such as vaccines or medical supplies.

What is covered by Medicare Supplement Plans?

Explore the benefits of Medicare Supplement Insurance (Medigap), designed to cover out-of-pocket expenses not included in Original Medicare. Understand the standardized plan options (A-N) to find the coverage that best suits your healthcare needs.

Medicare Part D Eligibility

Medicare Part D eligibility requirements, including enrollment via Medicare Part A and/or Part B, Medicare Advantage, and special considerations for individuals with disabilities or alternative benefits.

Who is eligible for Medicare Advantage?

Learn about Medicare Advantage (Part C) eligibility, enrollment steps, and key considerations. Find out if you qualify, compare plans, and get the coverage that best fits your healthcare needs.

Turning 65

If you are turning 65 and are planning to enroll in Medicare, here are some key steps you can use to prepare the right way.

Medicare Supplement Eligibility

To be eligible for a Medicare Supplement insurance plan, you must be enrolled in both Medicare Part A and Part B and be at least 65 years old.

Medicare Supplement Plans

Medicare Supplement insurance, also known as Medigap, is a type of private health insurance that can help cover some of the out-of-pocket costs that are not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Types of Medicare Advantage

See how different types of Medicare Advantage can impact your healthcare plan and each of their purposes. Get details on HMO Plans, PPO Plans, PFFS Plans, and SNP Plans.

What is Medicare Part D?

Medicare Part D is a federal program providing prescription drug coverage to Medicare beneficiaries, available through private insurance companies as standalone plans or integrated with Medicare Advantage.

New to Medicare

Getting ready to become a Medicare beneficiary can be daunting, especially if you’re already 65 years old or have a few years left before you retire.