The Different Types of Medicare Penalties and How to Avoid Them

Enrolling in Medicare is one of the most important steps you’ll take as you approach age 65. While Medicare provides valuable health coverage, many people don’t realize that there are penalties if you miss enrollment deadlines or go without certain types of coverage for too long. These penalties can be costly and, in some cases, permanent, so it’s essential to understand how they work and how to avoid them.

This article breaks down the different types of Medicare penalties, why they exist, and what you can do to steer clear of them.

Why Medicare Penalties Exist

Medicare penalties are designed to encourage people to enroll in coverage when they’re first eligible. If too many people waited until they needed care before signing up, the program would become much more expensive. By encouraging timely enrollment, Medicare helps spread the risk across more people and keep premiums stable.

Unfortunately, penalties can also catch people off guard. They often happen because someone misunderstood the rules or assumed their existing insurance was enough. That’s why being proactive and learning the basics can save you money in the long run.

The Part A Late Enrollment Penalty

Most people do not have to pay a premium for Medicare Part A (hospital insurance) because they or their spouse paid Medicare taxes long enough during their working years. However, if you don’t qualify for premium-free Part A and choose not to sign up when you’re first eligible, you may face a penalty.

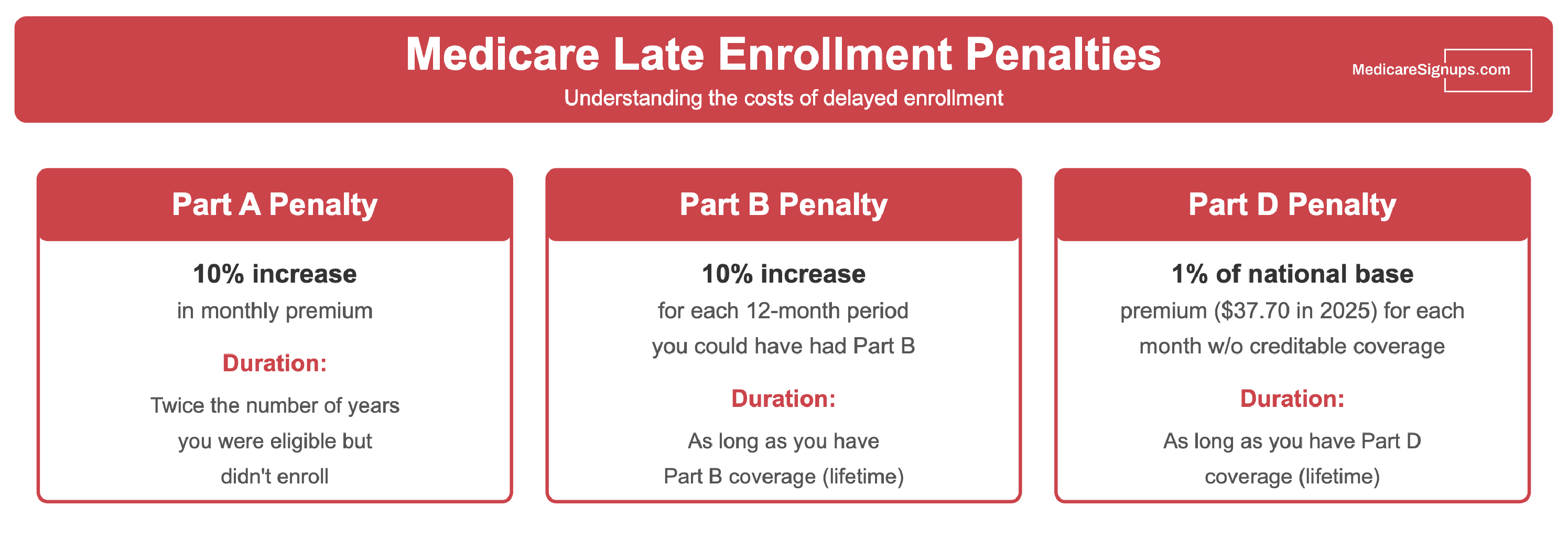

The Part A penalty adds 10% to your monthly premium, and you’ll have to pay it for twice the number of years you delayed enrollment. For example, if you waited two years, you’d pay the higher premium for four years. While this penalty isn’t permanent, it can still add up quickly.

The Part B Late Enrollment Penalty

Medicare Part B (medical insurance) covers doctor visits, outpatient care, and preventive services. Unlike Part A, everyone pays a monthly premium for Part B. If you don’t enroll when you’re first eligible, your premium may go up by 10% for each full 12-month period that you could have had Part B but didn’t.

What makes the Part B penalty especially tough is that it’s permanent. Once it’s added to your premium, you’ll continue paying the higher rate for as long as you have Part B coverage. The longer you delay, the larger the penalty becomes.

The Part D Late Enrollment Penalty

Prescription drug coverage is another area where Medicare enforces penalties. Medicare Part D helps cover the cost of prescription medications. If you go without creditable prescription drug coverage (coverage considered at least as good as Medicare’s) for 63 days or more after you’re eligible, you may face a penalty.

The Part D penalty is calculated by multiplying 1% of the “national base beneficiary premium” by the number of months you went without coverage. This amount is then added to your monthly Part D premium. Like Part B, the Part D penalty is permanent.

How to Avoid Medicare Penalties

The good news is that most Medicare penalties can be avoided with careful planning. Here are a few strategies:

-

Enroll during your Initial Enrollment Period (IEP). This seven-month window begins three months before the month you turn 65 and ends three months after. Signing up on time ensures you won’t face penalties.

-

Understand how other coverage affects Medicare. If you’re still working and have employer-sponsored insurance, you may be able to delay Medicare without a penalty. However, the rules vary depending on the size of your employer, so it’s important to check.

-

Don’t go without drug coverage. Even if you don’t currently take prescriptions, consider enrolling in a low-cost Part D plan to avoid future penalties.

-

Know your Special Enrollment Periods (SEPs). Certain life events, such as losing job-based coverage, may allow you to enroll later without penalty.

Continuing Without Penalty

Medicare penalties may feel confusing or even unfair, but they’re avoidable if you take time to understand the rules and act before deadlines pass. The key is not to wait until you need care. Review your options as you approach age 65, confirm how your current insurance works with Medicare, and consider enrolling in drug coverage even if your needs are minimal right now.

If you’re unsure about your situation, working with a licensed Medicare agent or broker can make the process easier. They can explain your choices, confirm whether your coverage is considered “creditable,” and help you avoid costly mistakes. By staying informed and enrolling on time, you can make the most of your Medicare benefits without the burden of unnecessary penalties.