Turning 65

If you are turning 65 and are planning to enroll in Medicare, there are a few steps you can take to prepare. Here are some things you can do to get ready for Medicare:

-

Start researching your options: Medicare consists of four parts (A, B, C, and D) and there are different ways to receive your Medicare benefits. Take some time to learn about the different parts of Medicare and the different types of plans available, such as Original Medicare, Medicare Supplement plans, and Medicare Advantage plans.

-

Review your health care needs and coverage: Think about your current health care needs and what types of coverage and services you will need under Medicare. This can help you decide which parts of Medicare you need to enroll in and what type of plan might be best for you.

-

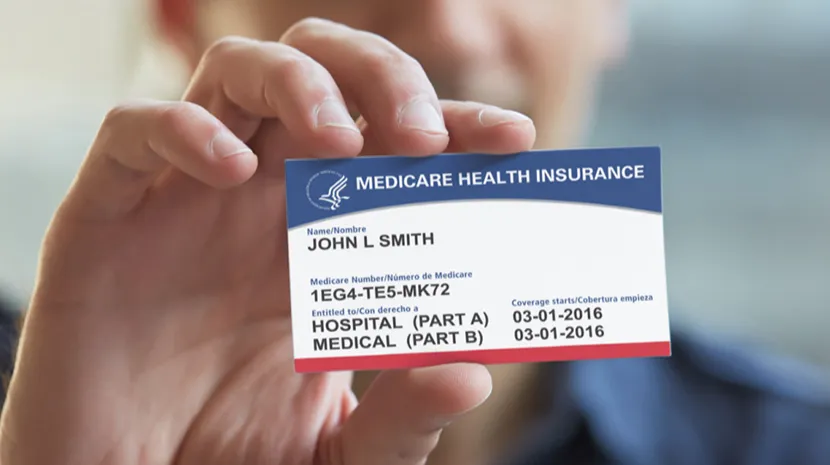

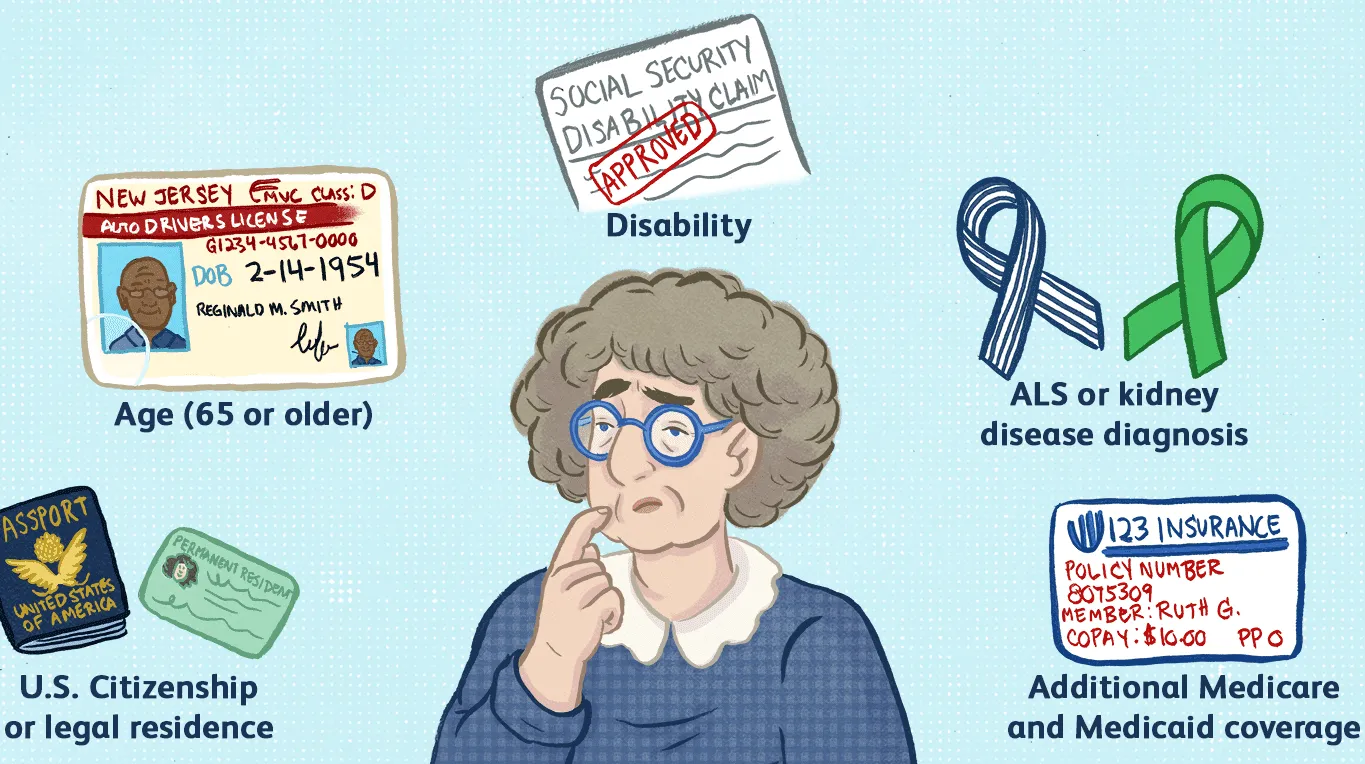

Check your eligibility: You are eligible for Medicare if you are 65 or older and a U.S. citizen or permanent resident. You can also be eligible if you are under 65 and have certain disabilities or conditions. You can check your eligibility and sign up for Medicare through the Social Security Administration.

-

Sign up for Medicare: Once you have decided which parts of Medicare you need and what type of plan you want, you can sign up for Medicare during your initial enrollment period. This is the seven-month period that starts three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. You can enroll online, by phone, or in person at a Social Security office.

-

Review your Medicare coverage: Once you have enrolled in Medicare, review your coverage to make sure you have the right parts and plan for your needs. You may have the opportunity to switch plans during certain times of the year, such as during the annual open enrollment period. It's also a good idea to review your coverage regularly to make sure it continues to meet your needs.

By taking these steps and doing your research, you can prepare for Medicare and ensure that you have the right coverage to meet your health care needs.