Medicare Supplement Plan G vs Plan N

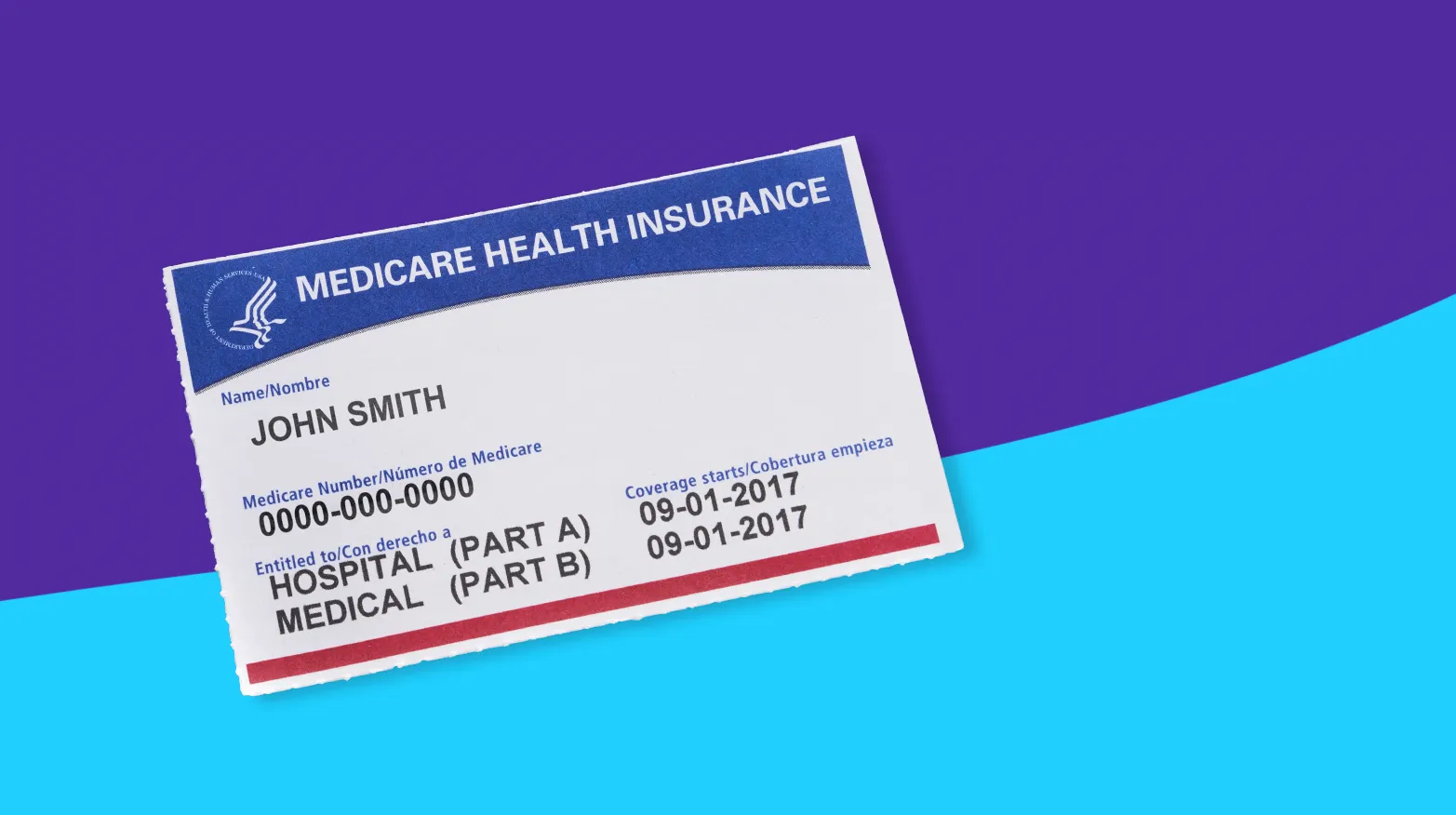

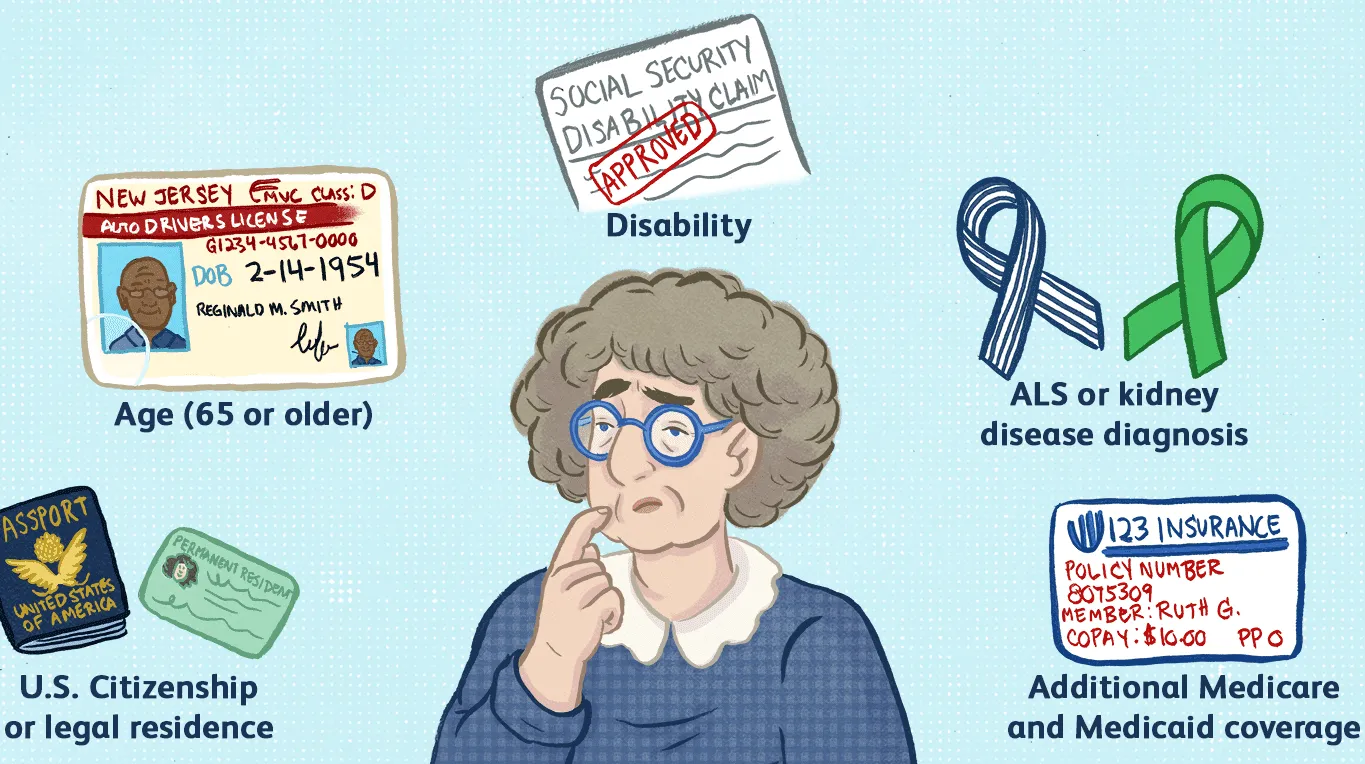

As a senior debating the differences between Medigap Plan G vs. Plan N, your main focus is the level of comprehensive coverage each offers. Medicare Supplements, also called Medigap plans, help cover the costs of healthcare not covered by Original Medicare. Generally, these plans pick up the medical costs Original Medicare does not. This can include coinsurance and copays.

Two popular options are Plan G and Plan N. We'll compare the two plans to help you make an informed decision about which one is right for you.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a type of insurance policy that helps cover the costs of healthcare not covered by Original Medicare. It covers most of the gaps in Original Medicare, including Part A deductibles, coinsurance, and copayments. Plan G is considered the most comprehensive Medigap plan, as the only cost not covered is the annual Medicare Part B deductible. Plan G also covers a certain amount of emergency medical care while traveling abroad, which is not covered by Original Medicare.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is another type of insurance policy that helps cover the costs of healthcare not covered by Original Medicare. It covers many of the same gaps as Plan G, including deductibles, coinsurance, and copayments. However, Plan N has slightly lower premiums than Plan G, and it may have some additional out-of-pocket costs, such as copays for office visits and emergency room visits. Like Plan G, Plan N doesn’t cover the Medicare Part B deductible, but does cover 100% of your Medicare Part B coinsurance costs. However unlike Plan G, you’ll pay a $20 copay for office visits and a $50 copay for emergency room (ER) visits

What are the differences between Plan G and Plan N?

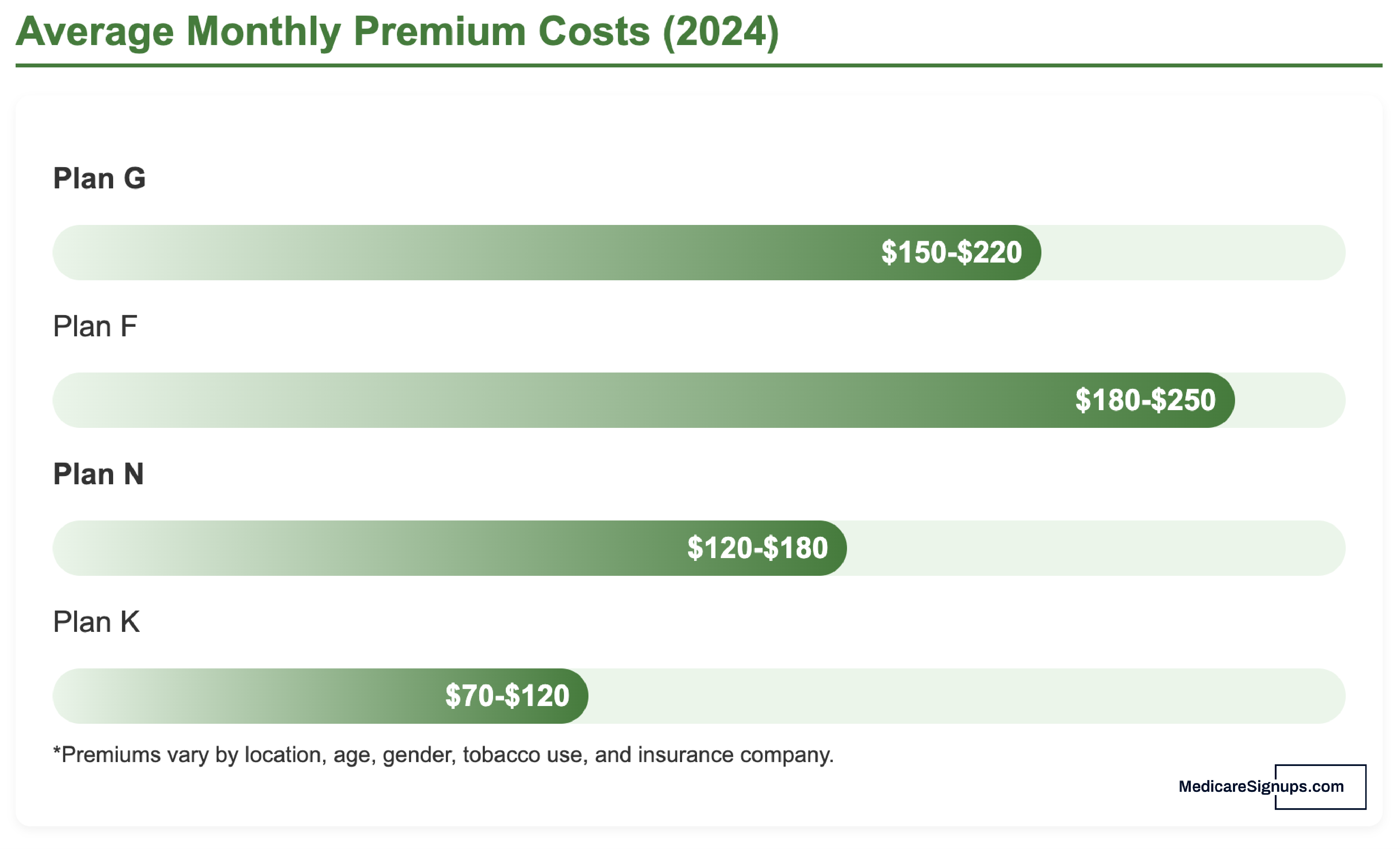

The main difference between Plan G and Plan N is the amount of coverage they provide. Plan G offers the most comprehensive Medigap medical coverage available, while Plan N has slightly lower premiums and may have some additional out-of-pocket costs. Here are some specific differences between the two plans:

-

Plan G covers the Part B deductible, while Plan N does not. This means that if you have Plan G, the insurance company will pay the deductible for you, while if you have Plan N, you will have to pay the deductible out of pocket.

-

Plan G covers excess charges, while Plan N does not. Excess charges are fees charged by a healthcare provider that are above the Medicare-approved amount. If you have Plan G, the insurance company will pay these excess charges for you. If you have Plan N, you will have to pay them yourself. Excess charges are rare, because the vast majority of doctors accept what’s called “Medicare Assignment.” When they happen, it can cost up to an additional 15% on your bill.

-

Plan G covers emergency medical care while traveling abroad, while Plan N does not. If you plan to travel outside the United States, you may want to consider Plan G for this added coverage.

-

Plan N requires copays for some services. With Plan N, you may have to pay a copay for office visits and emergency room visits. With Plan G, you will not have to pay copays for these services.

Which plan is right for you?

When deciding between Medicare Supplement Plan G and Plan N, you should consider your healthcare needs and budget. If you are looking for more comprehensive coverage and don't mind paying slightly higher premiums, Plan G may be the right choice for you. If you are looking for a more affordable option and are willing to pay some out-of-pocket costs, Plan N may be a good fit.

It's important to note that both Plan G and Plan N are only available to people who are enrolled in Original Medicare. If you are not enrolled in Original Medicare parts A and B, you will not be able to enroll in a Medicare Supplement plan.

In conclusion, Medicare Supplement Plan G and Plan N are both good options for seniors who want additional coverage for the costs of healthcare not covered by Original Medicare. Plan G offers more comprehensive coverage, while Plan N often has lower premiums and may have some additional out-of-pocket costs. It's important to consider your healthcare needs and budget when deciding which plan is right for you.