Is Vision Insurance Right For You?

Vision Insurance for Seniors: Understanding How it Relates to Medicare

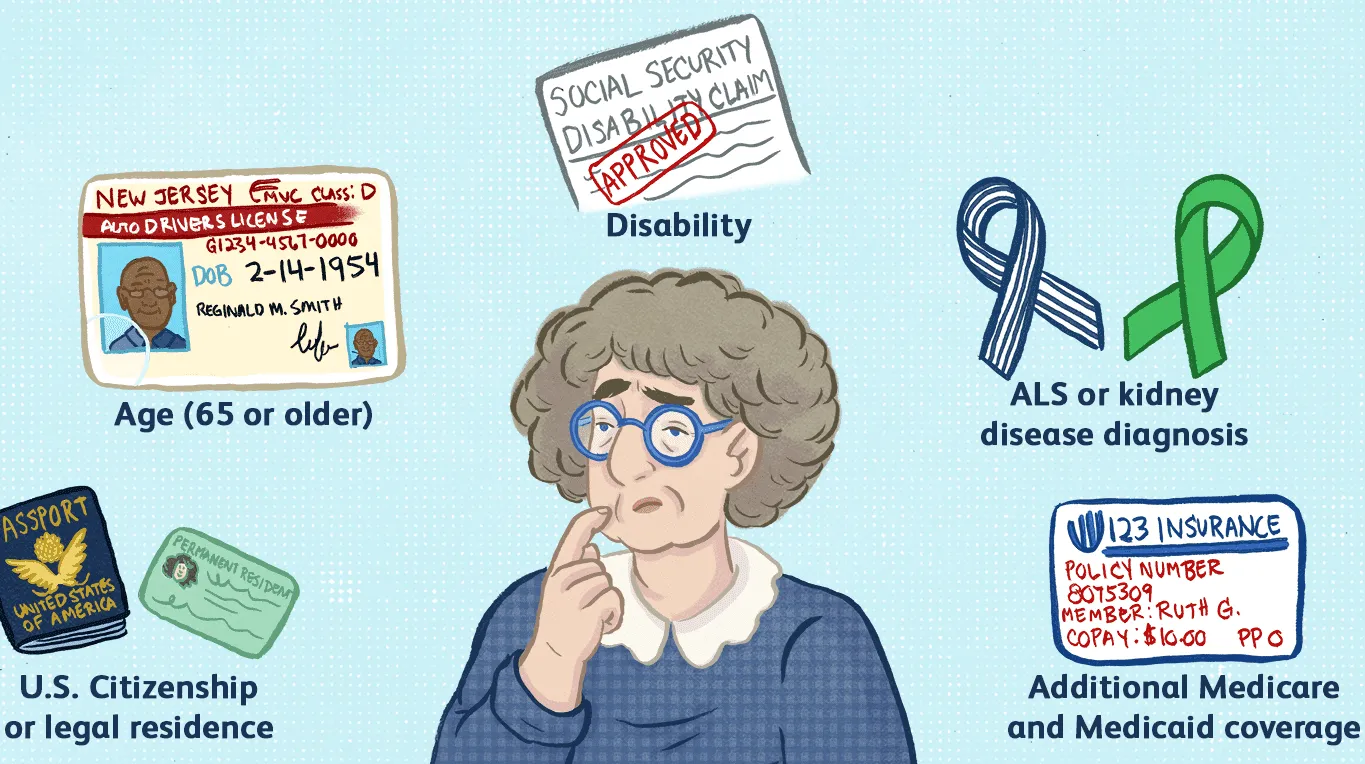

As we age, our vision often changes and can become more susceptible to conditions such as cataracts, glaucoma, and age-related macular degeneration. This is why it is important for seniors to have access to quality vision care. In the United States, seniors may be eligible for vision insurance through Medicare, the federal health insurance program for those over the age of 65.

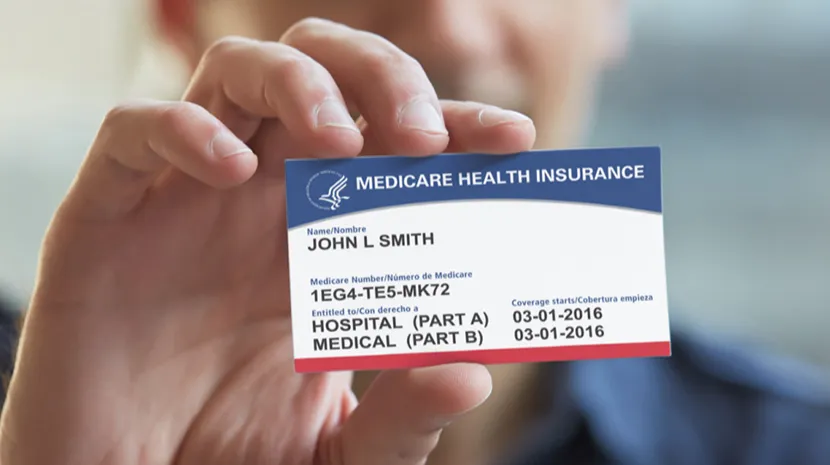

Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Part A covers hospital insurance, Part B covers medical insurance, Part C is an alternative to Parts A and B known as Medicare Advantage, and Part D covers prescription drug coverage. When it comes to vision care, Medicare Part B may cover certain services and supplies such as annual eye exams, glaucoma tests, and corneal refractive therapy. However, Medicare Part B does not cover routine vision exams, glasses, or contact lenses.

This is where vision insurance comes in. Vision insurance is a type of insurance that covers the cost of vision care services and supplies, such as routine eye exams, glasses, and contact lenses. In the United States, seniors may be able to purchase a separate vision insurance plan to supplement their Medicare coverage.

There are many vision insurance plans available in the United States, so it is important for seniors to compare their options and choose a plan that best meets their needs and budget. Some vision insurance plans may have a network of participating providers, meaning that seniors must receive care from a provider within the network in order to be covered. It is important to check with your vision insurance plan to see what providers are in network.

In addition to purchasing a separate vision insurance plan, seniors may also be able to get vision coverage through a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and are an alternative to Original Medicare (Parts A and B). These plans often include additional benefits such as vision coverage.

To summarize, vision insurance can be a valuable resource for seniors who want to maintain their eye health and vision. While Medicare Part B may cover some vision services and supplies, it does not cover routine vision care. Seniors may be able to purchase a separate vision insurance plan or enroll in a Medicare Advantage plan that includes vision coverage. By comparing their options and choosing a plan that meets their needs, seniors can access the vision care they need to maintain their eye health.