Medicare Supplement Plans

Medicare Supplement insurance, also known as Medigap, is a type of private health insurance that can help cover some of the out-of-pocket costs that are not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some of the main benefits of buying a Medicare Supplement insurance policy include:

- Peace of mind: Medicare Supplement insurance can help protect you from the high costs of medical care and give you peace of mind knowing that you will have coverage for your medical expenses.

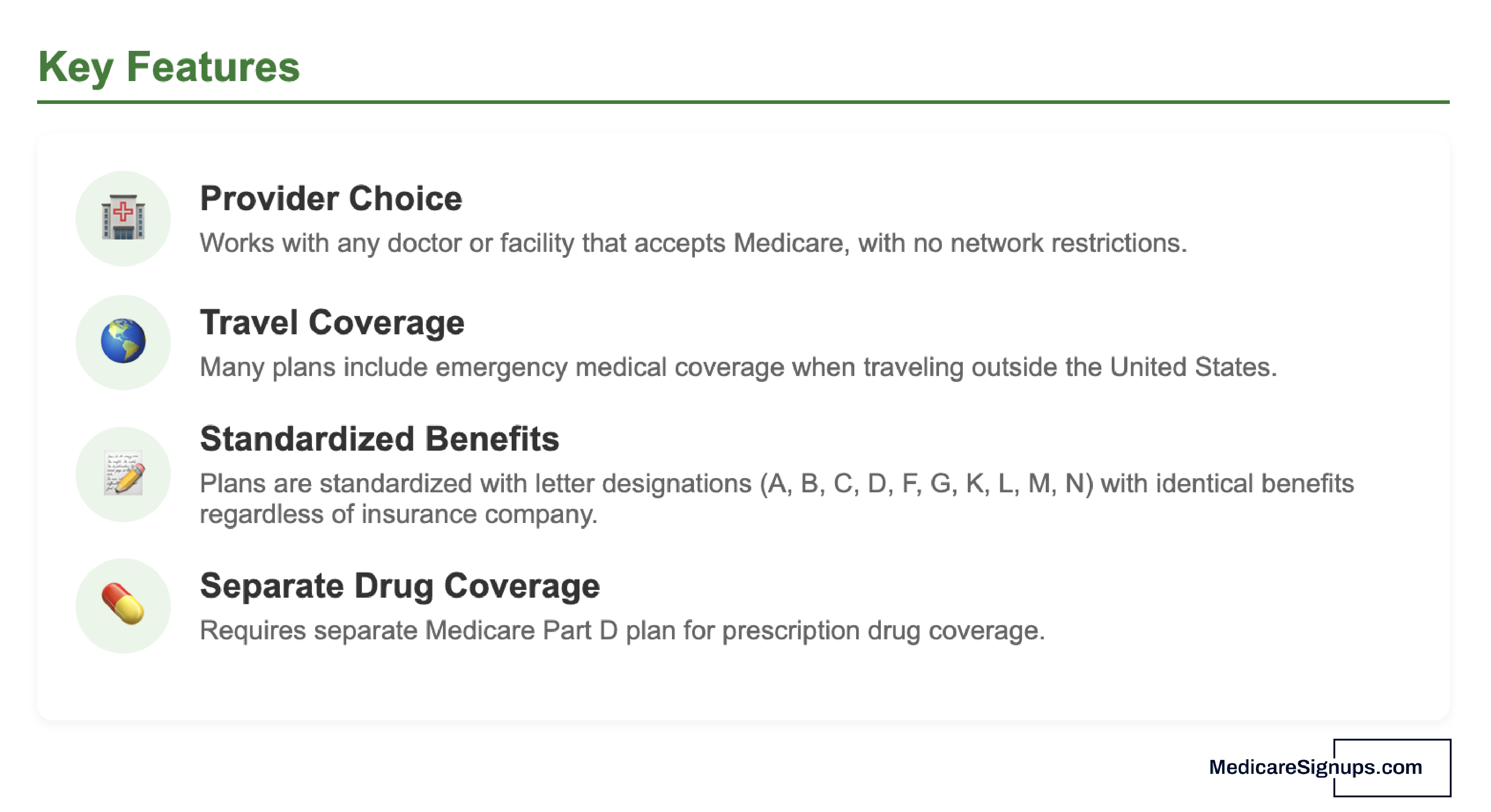

- Comprehensive coverage: Medicare Supplement insurance policies are standardized and offer a range of coverage options, so you can choose the policy that best fits your needs and budget.

- Flexibility: Medicare Supplement insurance allows you to see any doctor or hospital that accepts Medicare, so you have the freedom to choose your own medical providers.

- No network restrictions: Unlike Medicare Advantage plans, Medicare Supplement insurance has no network restrictions, so you can see any doctor or hospital that accepts Medicare.

- No claim forms: Medicare Supplement insurance policies do not require you to fill out claim forms, so you don't have to worry about the hassle of paperwork.

Overall, Medicare Supplement insurance can help provide you with the coverage and peace of mind you need to manage your medical expenses and get the medical care you need.