How To Enroll in Medicare

Are you looking for Medicare enrollment information for yourself or for someone else? In either case, enrolling in Medicare can be a relatively straightforward process especially with a Medicare Agent helping out, but there are a few important things to keep in mind.

First, it's important to understand that Medicare is a federal health insurance program that is available to people who are 65 years or older, as well as to some younger people with disabilities or certain medical conditions. To be eligible for Medicare, you must be a citizen or permanent resident of the United States.

If you are eligible for Medicare, you can enroll during your Initial Enrollment Period (IEP), which begins three months before the month you turn 65, the month you turn 65 and ends three months after the month you turn 65. This is a total of seven months. You can also enroll during the General Enrollment Period (GEP), which runs between January 1-March 31 each year. Your coverage will start the month after you sign up. If you miss your IEP and wait to sign up for Medicare Parts A and B until the GEP, you might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

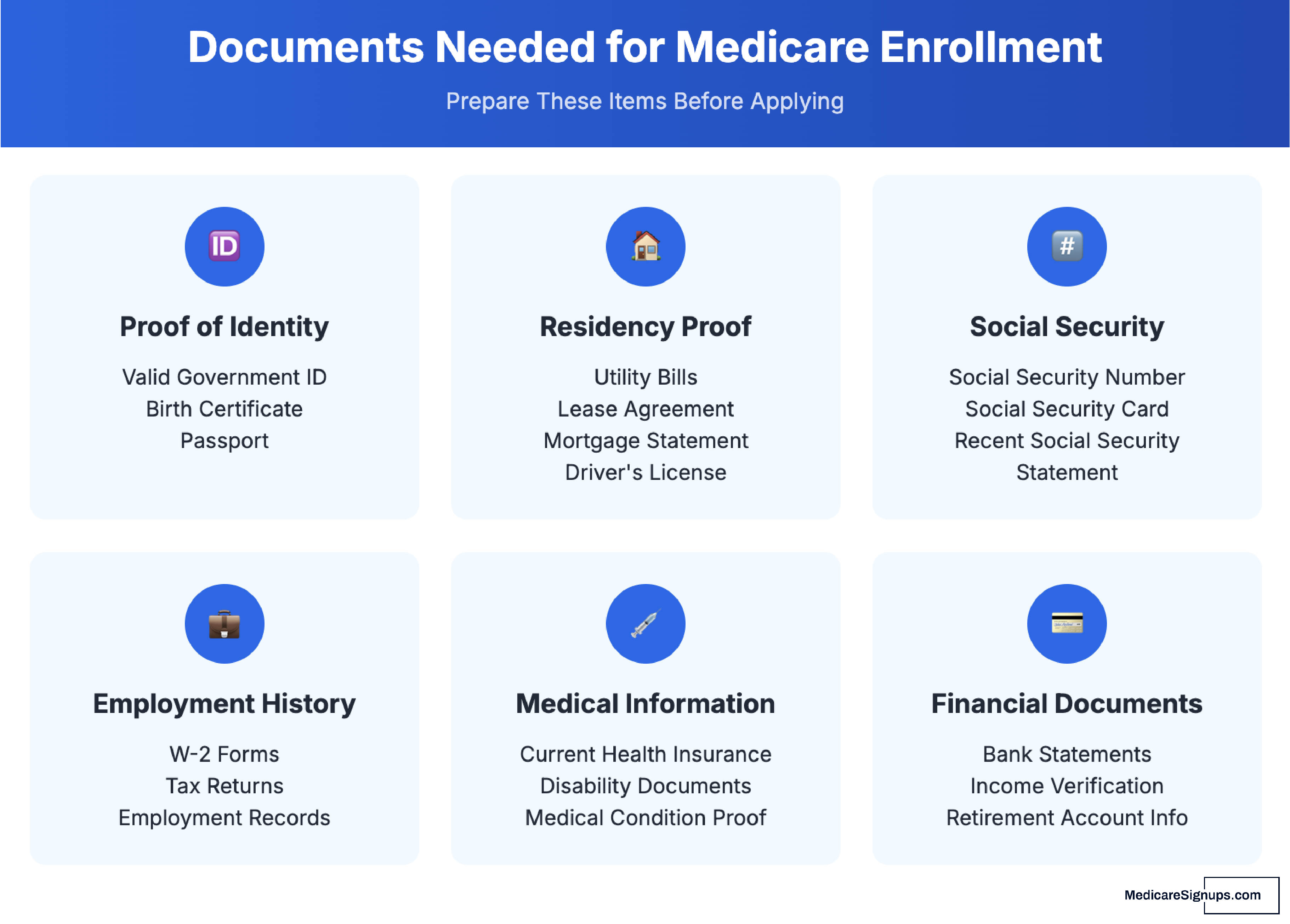

To enroll in Medicare, you will need to provide certain information, such as your name, date of birth, and Social Security number. You may also need to provide proof of your citizenship or permanent residency.

There are several different ways to enroll in Medicare, depending on your situation. If you are already receiving Social Security benefits, you will automatically be enrolled in Medicare when you turn 65. If you are not receiving Social Security benefits, you can enroll in Medicare by contacting Social Security or by visiting the Social Security website at www.ssa.gov.

Once you have enrolled in Medicare, you will need to choose a Medicare plan that meets your needs. There are three main types of Medicare plans: Original Medicare (Part A and Part B), adding a Medicare Supplement (also known as Medigap) plan “on top of” Original Medicare Parts A and B as well as a stand-alone Medicare Part D Prescription Drug Plan (PDP) and Medicare Advantage plans. Original Medicare is the traditional fee-for-service Medicare program, while Medicare Advantage plans are offered by private insurance companies and provide Medicare benefits through a managed care model.

To choose a Medicare plan, you will need to consider factors such as costs, benefits, and any additional restrictions that may apply. You can compare different Medicare plans on the Medicare website at www.medicare.gov, or you can contact Medicare or a licensed insurance agent for more information.

Overall, enrolling in Medicare can be a simple process, but due to the thousands of combinations of insurance and prescription drug coverage likely available in your area to purchase, it's important to carefully consider your options and choose the plan that best meets your needs. For more information about enrolling in Medicare, you can visit the Medicare website or contact Medicare directly.