Choosing Dental Coverage on Medicare

What Dental Services Are Covered by Medicare?

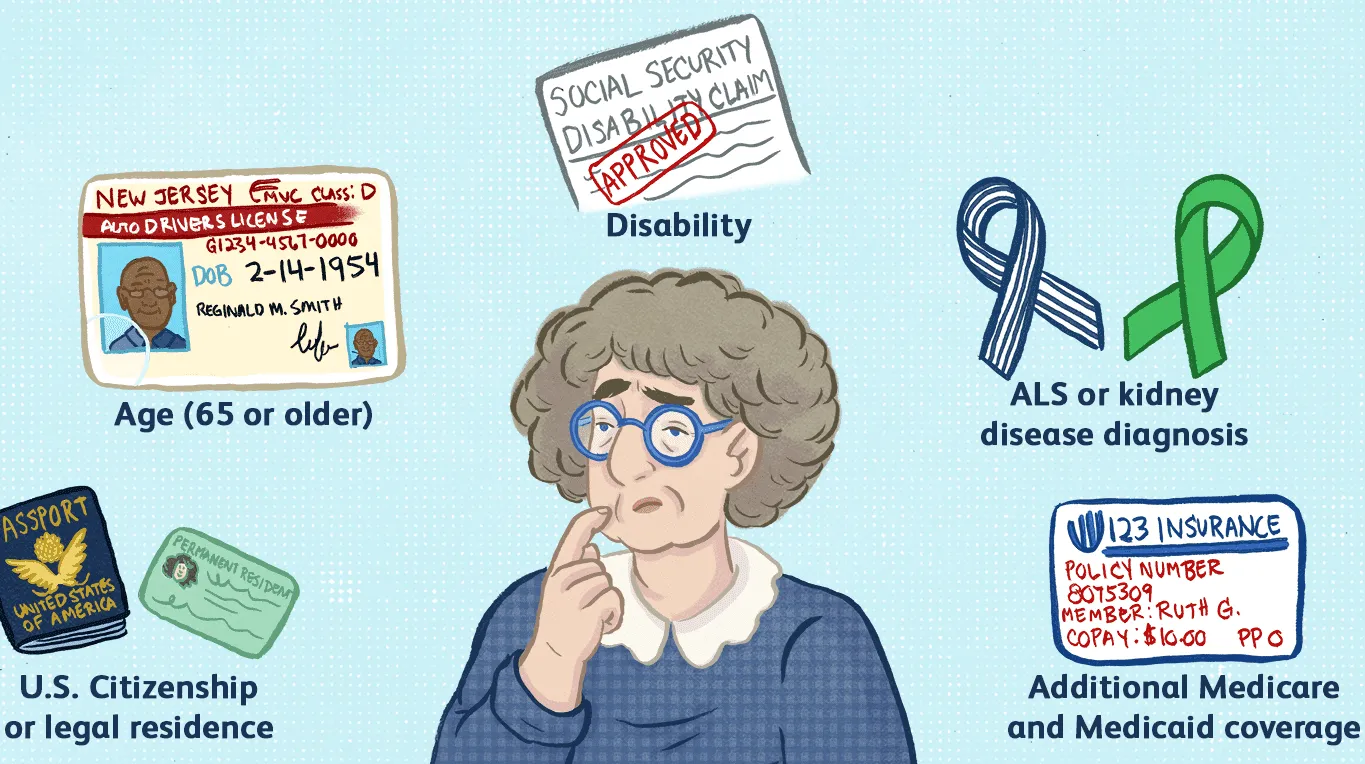

Getting proper dental care is very important for our health and well-being. Medicare Part B dental coverage is spotty at best, and not something that resembles what you’re likely used to as, “dental insurance.”

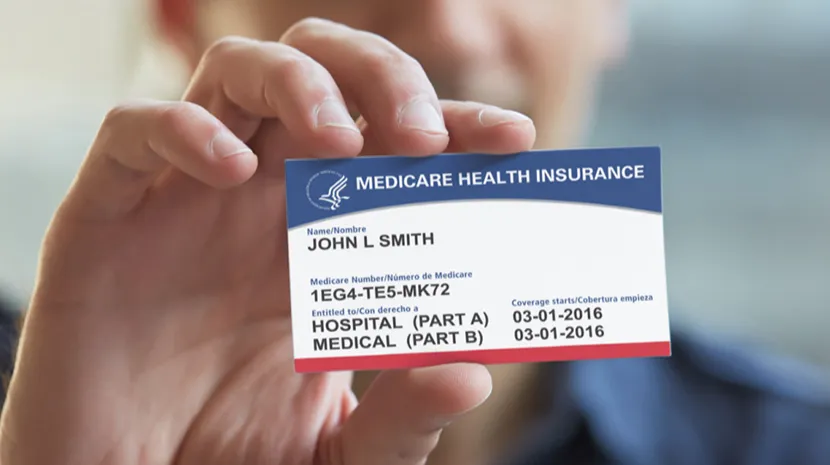

When you’re on Medicare, getting dental insurance is something you’ll likely have to purchase as an add-on to Original Medicare parts A and B. That’s because Original Medicare doesn’t include routine, basic or advanced dental care as part of your coverage. Medicare will only pay for dental services that are an integral part either of a covered procedure like jaw reconstruction following an accident, or for tooth extractions done in coordination with radiation treatments for diseases concerning the jaw.

It's a decision that should be made with multiple factors in mind, such as the type of coverage that will best suit your needs and budget. There are a variety of plans that can be used for various types of dental care, including dental insurance with no networks. However, most dental insurance policies use PPO (preferred provider organization) networks.

Why Dental Insurance is Important

There are numerous studies which show maintain healthy teeth and gums throughout your life is a very important part of your overall health. Gum disease can be linked to many illnesses, including diabetes, heart disease, and osteoporosis. Researchers at the University of North Carolina School of Dentistry discovered that people suffering from gum disease are twice as likely to die of a heart attack than others and three times more likely to suffer from stroke.

Unfortunately, if you are not able to afford the full cost of getting routine checkups and preventive dental care, it’s easy to skip or ignore those all-important regular checkups and cleanings. This could lead to serious dental issues which could undermine your overall health as you age. A dental insurance policy can help you support the health of your teeth.

Two Types of Medicare Dental Insurance Coverage

There are generally two ways to go about getting dental insurance when you’re on Medicare.

Medicare Advantage Dental

There generally are no “free” ways to get dental for seniors on Medicare, but there are Medicare Advantage plans that have a $0 monthly plan premium that include dental insurance. In fact, many older adults and seniors end up choosing a Medicare Advantage plan as a way to “consume” their Medicare coverage because of those dental benefits.

If you get dental insurance as a part of a Medicare Advantage plan, you’ll want to pay attention to the amount of coverage it provides. Often, the benefits and amount of coverage these dental insurance plans embedded within a Medicare Advantage plan vary wildly. Some will cover up to $1,000 in dental coverage for a calendar year, and others may be in the $3,000 upwards of $5,000 per year.

Stand-alone Dental Insurance Policies

If you only have Original Medicare A and B, and even if you have a Medicare Supplement or Medigap plan, you still have limited dental benefits. If you’d like to have dental insurance on top of Original Medicare with or without a Medigap plan, you’ll have to buy one.

Unlike dental benefits embedded within Medicare Advantage plans, stand-alone dental insurance policies typically provide a wider selection of providers. Many Medicare insurance agents can offer any number of individual dental policies. If you don’t have a Medicare insurance agent, you can click here to find a Medicare agent near you.

If you’d like to buy one yourself, it’s fairly easy to do online. Just search for “senior dental insurance” and a whole host of companies and options will pop up. My expert advice? Pick a well-known, brand-name dental insurance company.

Your dental insurance coverage can vary from one policy to another and from one provider to another. Before you sign up for a policy, it's important that you thoroughly understand the terms and conditions of the policy.

What Does Dental Insurance Usually Cover?

Most dental insurance policies and plans cover the basic costs associated with preventing dental problems. These include the cost of cleanings, exams, and other procedures that are designed to prevent gum disease and tooth decay. This type of coverage is very important as it encourages people to get regular dental care.

Most dental insurance policies and plans also cover certain procedures such as tooth extractions, fillings, and fixing missing teeth. However, these procedures and services vary depending on the insurance coverage you get through a Medicare Advantage plan or a traditional stand-alone dental insurance plan. Since many providers provide a significant portion of basic dental care, it's important to select a policy that provides coverage for all of the procedures and procedures that are needed.

Although some policies do not provide coverage for major dental procedures, some policies can provide a partial benefit for these services. These include the cost of certain procedures such as dental surgery and dentures. If you are planning on having major dental care in the future, it's important to find a provider that can provide you with a significant portion of the cost.

One last word of advice: Read the fine print! Even though a dental benefit inside a Medicare Advantage plan, or a stand-alone dental insurance policy may offer an annual spending amount of $3,000, $4,000 or even $5,000, it’s important to understand what procedures are actually covered! Many of these plans do not cover high-dollar items like dentures, crowns and other expensive procedures. That’s why, before you sign up for a policy, it's important that you thoroughly understand the terms and conditions of the policy.