Comparing Medicare Plans: A Step-By-Step Financial Checklist

Choosing the right Medicare plan isn’t just about picking the one with the most benefits, it’s about understanding how those benefits align with your finances. Whether you’re evaluating options for the first time or looking to refresh your current coverage, carefully weighing costs against expected healthcare needs is essential. Following this step-by-step financial checklist can help you compare different types of Medicare plans, combinations, and income-based costs in a clear, practical way.

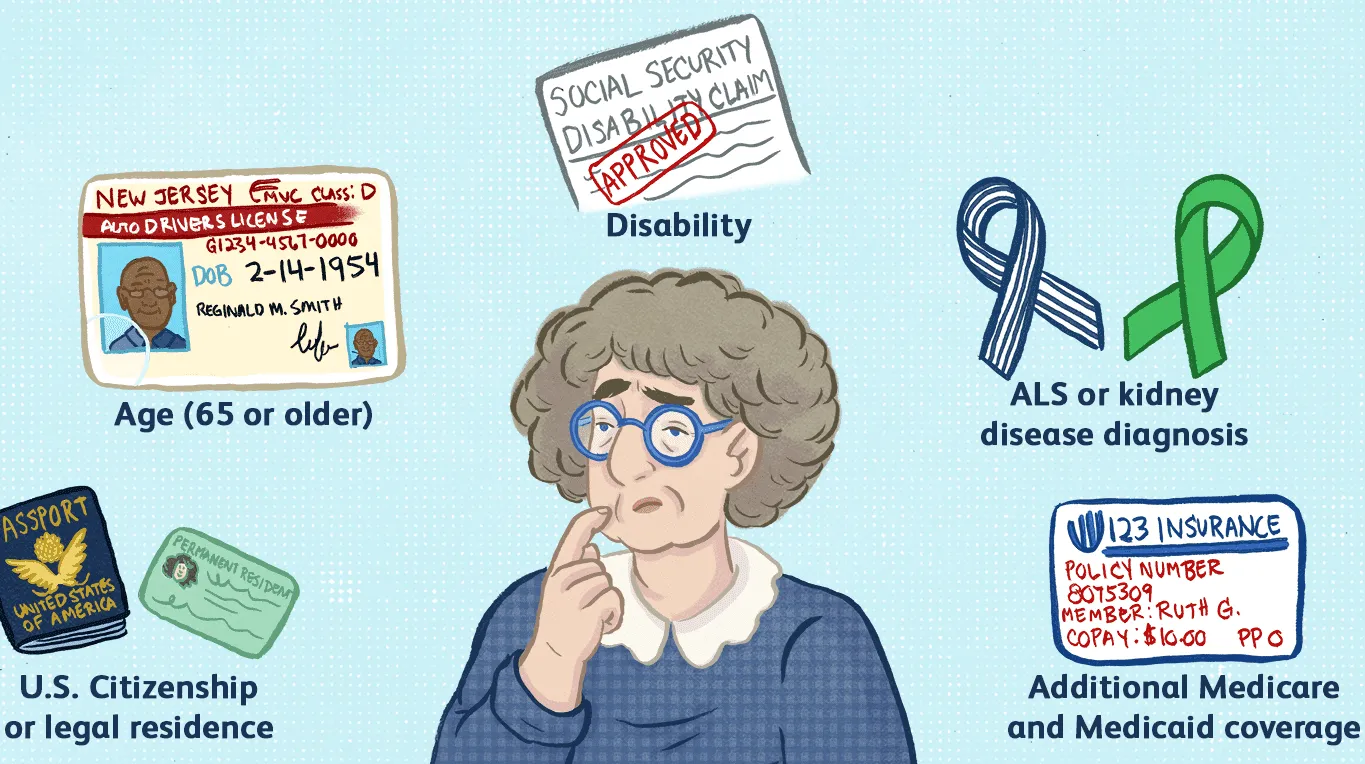

Step 1: Understand the Basic Structure of Medicare

Before comparing cost differences, start with a clear understanding of the types of plans available:

-

Original Medicare (Part A and Part B): Part A covers hospital care. Part B covers outpatient care and doctor visits. Most people don’t pay a premium for Part A, but Part B comes with a standard monthly premium that increases with income (known as the IRMAA surcharge).

-

Medicare Advantage (Part C): An alternative to Original Medicare that bundles Parts A and B (and usually Part D) in a single, private plan. These often come with additional benefits like dental and vision.

-

Prescription Drug Plans (Part D): Standalone coverage for prescriptions. These plans vary in cost depending on the formulary and coverage tiers.

-

Medigap (Supplement) Policies: Private plans that cover the “gaps” in Original Medicare, such as copays, coinsurance, and deductibles.

You can pair Original Medicare + Part D + Medigap, or choose Medicare Advantage instead. You generally cannot combine Medicare Advantage with Medigap.

Step 2: Estimate Your Annual Premium Costs Based on Income

Premiums vary not just by plan type, but by income level. Start by identifying where you fall in the income brackets used to determine premium adjustments. Retirees with higher modified adjusted gross incomes may pay more for Part B and Part D due to IRMAA surcharges.

Once you know your bracket:

-

Add the monthly Part B premium (and IRMAA, if applicable).

-

Include the cost of a standalone Part D plan if you’re using Original Medicare.

-

If considering Medicare Advantage, note that some plans offer $0 premiums, but many others charge small to moderate monthly fees.

-

For Medigap, expect fixed premiums that depend on your age, plan level (Plan G, Plan N, etc.), and state. These plans are not income-based, so premiums are the same regardless of income.

Multiply all monthly premiums by 12 to calculate the annual premium cost. Keep that figure available; it will anchor the rest of your comparisons.

Step 3: Anticipate Your Out-of-Pocket Costs

After premiums, the next major component to compare is out-of-pocket spending. This includes deductibles, copayments, and coinsurance.

Original Medicare + Medigap Combination:

With most Medigap plans (e.g., Plan G), your out-of-pocket costs are limited to the Part B deductible and any services not covered. This offers predictability but requires paying a higher monthly premium.

Original Medicare Without Medigap:

You’ll pay 20% of most services after satisfying the deductibles. This could be financially risky for frequent users of healthcare services.

Medicare Advantage:

These plans typically feature copays for every service (office visits, specialist visits, urgent care, etc.). They do set an annual out-of-pocket maximum and once reached, the plan covers 100% of additional costs. Note that maximums vary significantly between plans, ranging from around $3,000 to over $8,000 per year.

Create a rough estimate of how many doctor visits, lab tests, prescription refills, and hospital visits you expect in a typical year. Then apply approximate copay amounts from the plans you’re comparing. Even a high-level estimate will clarify whether a low-premium but high-copay plan is truly cost-effective for your situation.

Step 4: Factor In Prescription Coverage

Prescription costs can swing the total cost of a plan dramatically.

If using Original Medicare, research the formulary of different Part D plans and estimate annual prescription spending using your current medications. Make sure to include deductible amounts and tier-based coinsurance rates.

If considering Medicare Advantage, confirm that your medications are covered under the included prescription benefit. Some low-cost Advantage plans look attractive on paper until you discover your primary medication is out-of-network or falls in a high-cost tier.

Step 5: Account for Unexpected or Long-Term Care Costs

One of the most overlooked cost categories is unexpected or chronic-care expenses. Ask yourself:

-

Do I expect more frequent care due to existing conditions?

-

How would emergency hospitalizations impact my budget under each plan?

-

Will travel or living in multiple states require broader coverage?

For example, an Advantage plan with a low out-of-pocket maximum might cost slightly more in monthly premium but may offer valuable protection in a year with unexpected health events. Likewise, someone who rarely visits doctors but takes regular prescriptions may find a low-premium Advantage plan more affordable than Medigap.

Step 6: Re-Calculate Annually

Medicare costs aren’t static. Premiums and copays change each year, and your personal financial situation may evolve. During the Annual Enrollment Period:

-

Recalculate your total estimated cost by repeating the same premium + spending process.

-

Compare how your current plan stacks up against newly available plans.

-

Consider whether changes to income (moving into or out of IRMAA thresholds) will impact your monthly cost.

Even if you’ve been happy with your plan for years, a quick recalculation might reveal better value elsewhere.

Find What Works for You…

There’s no Medicare plan that works for everyone. A higher-income earner who expects frequent specialist visits might ultimately spend less under an Original Medicare + Medigap pairing, despite higher monthly premiums. A retiree on a fixed income with relatively low ongoing healthcare needs may benefit more from the predictable structure of a Medicare Advantage plan. By walking through this checklist and calculating your total costs (rather than focusing on premiums alone) you can make a more confident and financially sound Medicare decision.