Best Medicare Options for Frequent Travelers: Original Medicare vs. Medicare Advantage

For many retirees, life after 65 isn’t about slowing down, it’s about seeing more of the world. Whether you’re spending summers in another state, taking cross-country road trips, or venturing abroad, your health coverage needs to travel with you. But not all Medicare plans work the same way once you’re on the move.

If you travel often, choosing between Original Medicare and Medicare Advantage (Part C) can make a big difference in how easily you can access care and how much it costs when you do. Let’s break down how each option stacks up for people who live life on the go.

How Original Medicare Works When You Travel

Original Medicare (Parts A and B) is administered by the federal government, which means your coverage is accepted nationwide by any doctor or hospital that takes Medicare. For travelers, that’s a big plus.

If you’re in another state and need care, you can typically visit any Medicare-approved provider without needing referrals or worrying about being “out of network.” There’s a freedom here that appeals to snowbirds and cross-country adventurers alike.

Pros for travelers:

-

Nationwide coverage: Nearly any U.S. hospital or doctor who accepts Medicare is an option.

-

No provider networks: You don’t have to switch doctors or get special permission to see a new one.

-

Ease of emergency care: If you’re injured or fall ill on the road, you can get treated almost anywhere in the U.S.

However, there’s a catch: Original Medicare doesn’t cover care outside the United States in most situations. There are a few narrow exceptions (for example, if you’re traveling between Alaska and another U.S. state through Canada and have an emergency), but these are rare.

If international travel is part of your lifestyle, you’ll likely want a Medigap (Medicare Supplement) plan, specifically one that includes foreign travel emergency coverage. Plans C, D, F, G, M, and N all include up to 80% coverage for foreign travel emergencies, up to plan limits.

In short: Original Medicare with a Medigap policy is often the most flexible option for frequent travelers within the U.S., and the best safety net for those who occasionally go abroad.

How Medicare Advantage Plans Handle Travel

Medicare Advantage (Part C) plans are offered by private insurance companies, and their coverage depends heavily on provider networks. That means your access to care can be more limited when you’re outside your plan’s service area.

Most Medicare Advantage plans are either HMOs (Health Maintenance Organizations) or PPOs (Preferred Provider Organizations). Here’s how they differ for travelers:

-

HMO plans typically require you to use in-network providers for non-emergency care. If you go outside your service area, you’ll likely pay the full cost unless it’s an emergency.

-

PPO plans offer more flexibility. You can usually see out-of-network providers, though you’ll pay more than if you stick with in-network ones.

If you split your time between two states or frequently move around, this can get tricky. Your “home ZIP code” determines what plans you’re eligible for, and Medicare Advantage plans only have to cover emergency or urgent care outside that area.

That said, some insurers are getting more travel-friendly. Certain national PPO networks and Medicare Advantage plans designed for snowbirds allow access to a wider network of providers across multiple states. Others offer telehealth, nationwide urgent care partnerships, or travel coverage programs that make it easier to manage your care while away.

Still, you’ll want to read the fine print carefully, because not every Medicare Advantage plan offers these features.

Pros for travelers:

-

May include extra benefits like vision, hearing, dental, and fitness programs.

-

Some plans offer emergency coverage abroad.

-

Telehealth access can help you stay connected with providers anywhere.

Cons for travelers:

-

Network restrictions can limit access outside your home area.

-

Out-of-network care may cost significantly more.

-

Plans can vary widely between states, which complicates seasonal moves.

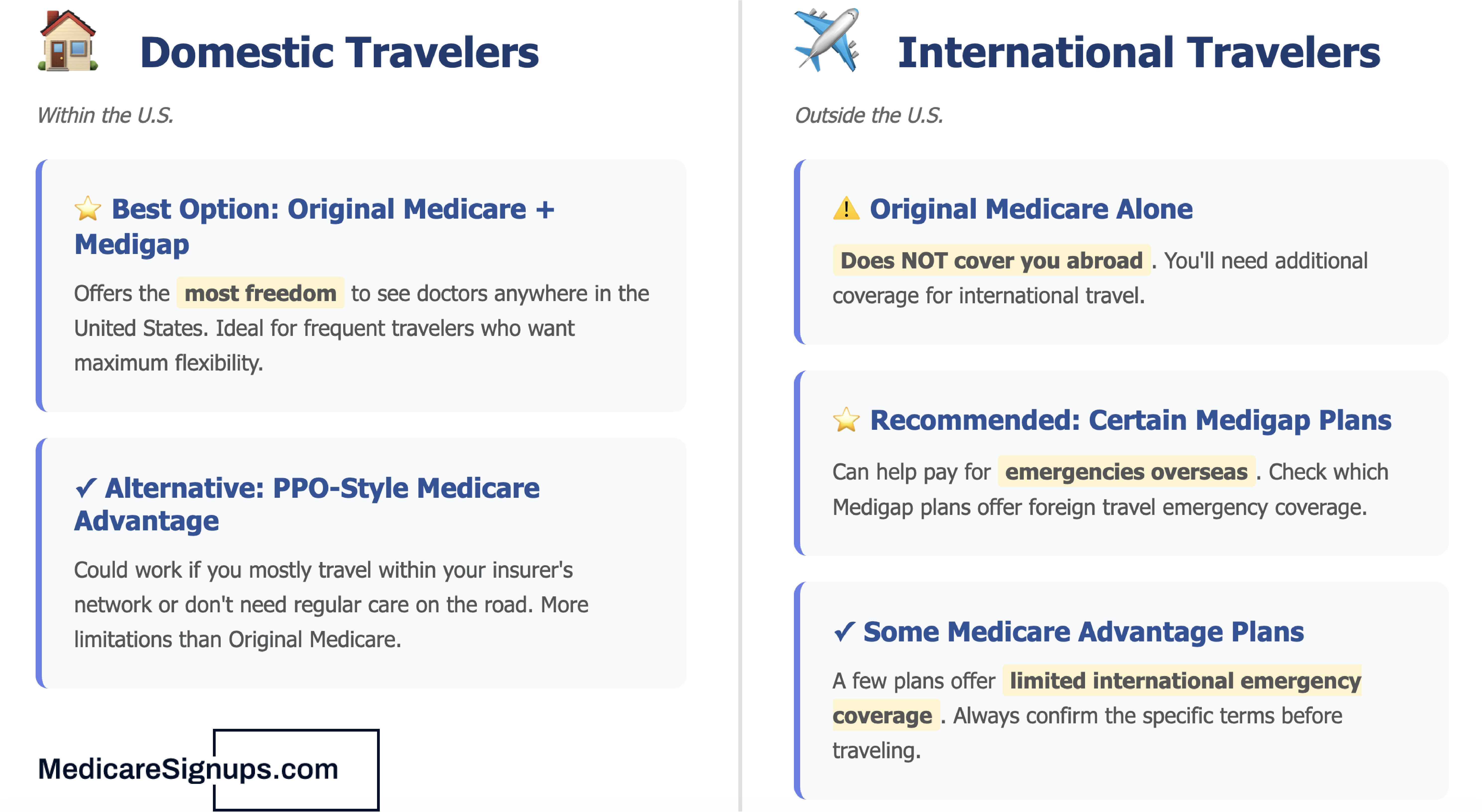

Domestic Travel vs. International Travel

Your destination matters when it comes to Medicare.

-

Domestic travelers (within the U.S.): Original Medicare plus Medigap offers the most freedom to see doctors anywhere. A PPO-style Medicare Advantage plan could work if you mostly travel within your insurer’s network or don’t need regular care on the road.

-

International travelers: Original Medicare alone doesn’t cover you abroad, but certain Medigap plans can help pay for emergencies overseas. A few Medicare Advantage plans offer limited international emergency coverage, but always confirm the terms before traveling.

If you plan to be out of the country for extended periods, you might also want to consider supplemental travel medical insurance (even with Medigap coverage) since Medicare’s foreign travel benefits have dollar and time limits.

Which Medicare Option Is Best for Frequent Travelers?

The right Medicare option for you largely depends on your travel habits and where your adventures take you. If you often find yourself exploring different parts of the United States, Original Medicare paired with a Medigap plan tends to offer the most flexibility. This combination allows you to see nearly any provider nationwide without worrying about network restrictions, which makes it ideal for people who spend significant time in multiple states or travel frequently by road or air.

For those who occasionally travel abroad, a Medigap plan that includes foreign travel emergency coverage provides valuable peace of mind. These plans help cover emergency medical costs outside the U.S., offering an extra layer of protection that Original Medicare alone doesn’t provide.

If you prefer the added benefits that come with Medicare Advantage, such as vision, dental, hearing, and fitness programs, you can still find options that work for travelers. The key is to look for a PPO-style plan with a large or national network, and to confirm that the plan includes travel coverage and telehealth services. These features can make it easier to access care while away from home, though you’ll want to double-check the network details for each destination you visit.

For “snowbirds” or people who split their time between two homes, like spending winters in Florida and summers in Michigan, it’s especially important to verify whether a Medicare Advantage plan covers both areas. If it doesn’t, you may need to switch plans during the Annual Enrollment Period, which runs from October 15 through December 7.

The Ultimate Solution

When your life takes you beyond one zip code, your health coverage needs to keep pace. Original Medicare with a Medigap policy generally offers the most reliable protection and convenience for travelers. Especially those who want access to any provider across the U.S. or who travel internationally.

Medicare Advantage can still be a great choice for some, particularly if you value bundled benefits or primarily stay within one region. Just be sure to verify how your plan handles care away from home before you pack your bags.